July 2: New equity added and some changes

Today during market hours, we added a new position and made adjustments to the portfolio. These updates were shared live in the Substack chat exclusively for members. Due to some concerns from paid members, this content was temporarily locked behind a paywall. However, now that the market has closed and paid members already got the alert, I have temporarily disabled the paywall in the chat for anyone who wants to review the changes. Below you’ll find the new additions and updates to the portfolio, along with the portfolio summary as of today. I’ve also included a screenshot of the chat messages that paid members received. Soon everything will be behind paywall. Consider subscribing to receive notifications so that you don’t miss out any any key entries.

🟩 Today’s Changes

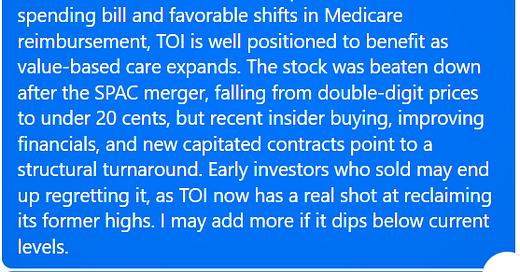

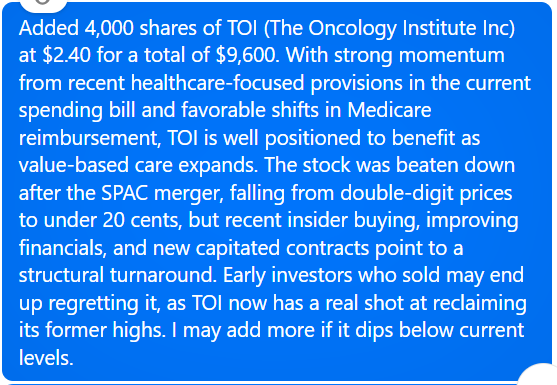

Added Long: $TOI – 4,000 shares @ $2.40 (June 30, 2025) = $9,600

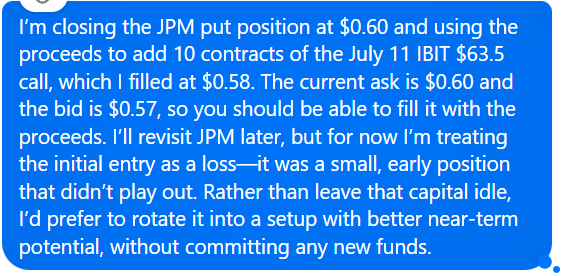

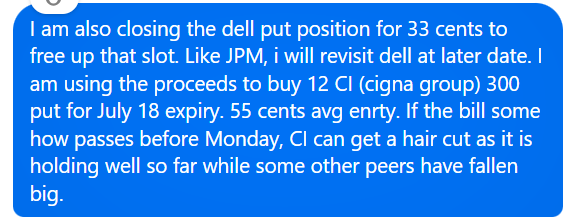

Buy to Open: $DELL Jul 18 ’25 $110 Put – 20 contracts @ $1.40 (June 23, 2025) = $2,800Sold to Close @ $0.33 (June 30, 2025) = $660 (–76.4%)Buy to Open: $JPM Jul 18 ’25 $260 Put – 10 contracts @ $2.70 (June 23, 2025) = $2,700Sold to Close @ $0.60 (June 30, 2025) = $600 (–77.8%)Buy to Open: $IBIT Jul 11 ’25 $63.5 Call – 10 contracts @ $0.58 (June 30, 2025) = $580

Buy to Open: $CI Jul 18 ’25 $300 Put – 12 contracts @ $0.55 (June 30, 2025) = $660

📊 Portfolio Summary (as of July 2, 2025)

🔹 Equity Positions

Long:

$OXY – 100 shares @ $43.85 (June 23, 2025) = $4,385

$SLB – 150 shares @ $34.00 (June 23, 2025) = $5,100

$GOOGL – 40 shares @ $163.00 (June 23, 2025) = $6,520

$HAL – 200 shares @ $20.85 (June 23, 2025) = $4,170

$ETHA – 300 shares @ $18.39 (June 26, 2025) = $5,517

$AAPL – 100 shares @ $201.00 (June 27, 2025) = $20,100

$TOI – 4,000 shares @ $2.40 (June 30, 2025) = $9,600

Short:

$MSFT – 10 shares @ $487.00 (June 23, 2025) = +$4,870

$TSLA – 25 shares @ $355.00 (June 23, 2025) = +$8,875

$NVDA – 50 shares @ $144.40 (June 23, 2025) = +$7,220

🔹 Options Positions

Buy to Open: $DELL Jul 18 ’25 $110 Put – 20 contracts @ $1.40 (June 23, 2025) = $2,800Sold to Close @ $0.33 (June 30, 2025) = $660 (–76.4%)Buy to Open: $FANG Sep 19 ’25 $160 Call – 15 contracts @ $3.90 (June 23, 2025) = $5,850

Buy to Open: $JPM Jul 18 ’25 $260 Put – 10 contracts @ $2.70 (June 23, 2025) = $2,700Sold to Close @ $0.60 (June 30, 2025) = $600 (–77.8%)Buy to Open: $ETHA Jul 18 ’25 $20 Call – 20 contracts @ $0.61 (June 26, 2025) = $1,220

Buy to Open: $AAPL Jul 11 ’25 $215 Call – 50 contracts @ $0.30 (June 27, 2025) = $1,500

Buy to Open: $IBIT Jul 11 ’25 $63.5 Call – 10 contracts @ $0.58 (June 30, 2025) = $580

Buy to Open: $CI Jul 18 ’25 $300 Put – 12 contracts @ $0.55 (June 30, 2025) = $660

💰 Updated Cash Balance

Starting Cash: $100,000

Less Long Equities: –$55,392

Less Options Premiums Paid (open only): –$9,810

Add Proceeds from Shorts: +$20,965

Add Proceeds from Closed Options: +$1,260

👉 Current Cash Balance: $56,363