This week was relatively active, with five strong positions closed for gains ranging from 18% to 355%. Since launching the Best 25 Holdings Portfolio on June 23 with a starting capital of $100,000, the total value has grown to approximately $128,174.40 as of the July 11 market close — a return of +28.17% in just three weeks. Of that, 21.24% came from options trades and 6.93% from equities. It’s a great start, and we’re just getting warmed up.

I'm currently working on a comprehensive spreadsheet that will show the current holdings of the Best 25 Holdings Portfolio with live prices, portfolio moves, and a complete trade log since inception. Until it's ready, I'll include the full log and all portfolio actions in these updates for anyone who wants to track our progress in detail. Below is what happened this week and as well as summary since inception. Below all that there is some more IMPORTANT information, so please read everything

This Week's Changes

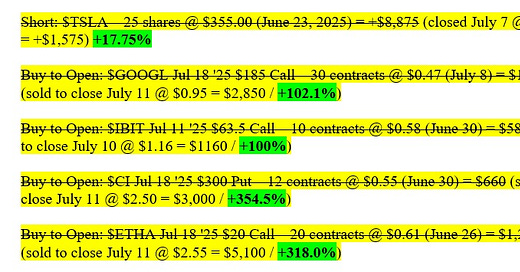

Short: $TSLA – 25 shares @ $355.00 (June 23, 2025) = +$8,875(closed July 7 @ $292 = +$1,575) +17.75%Buy to Open: $GOOGL Jul 18 '25 $185 Call – 30 contracts @ $0.47 (July 8) = $1,410**(sold to close July 11 @ $0.95 = $2,850 / +102.1%)Long: $CRM – 50 shares @ $270.00 (July 9) = $13,500

Buy to Open: $IBIT Jul 11 '25 $63.5 Call – 10 contracts @ $0.58 (June 30) = $580*(sold to close July 10 @ $1.16 = +$1160 / +100%)Buy to Open: $CI Jul 18 '25 $300 Put – 12 contracts @ $0.55 (June 30) = $660*(sold to close July 11 @ $2.50 = $3,000 / +354.5%)Buy to Open: $ETHA Jul 18 '25 $20 Call – 20 contracts @ $0.61 (June 26) = $1,220*(sold to close July 11 @ $2.55 = $5,100 / +318.0%)Buy to Open: $LMT Sep 19 '25 $550 Call – 50 contracts @ $2.00 (July 11) = $10,000

📊 Portfolio Summary (as of July 11, 2025)

Inception Date: June 23, 2025

🔹 Equity Positions

Long:

$OXY: 100 shares @ $43.85 (June 23, 2025)

$SLB: 150 shares @ $34.00 (June 23, 2025)

$GOOGL: 40 shares @ $163.00 (June 23, 2025)

$HAL: 200 shares @ $20.85 (June 23, 2025)

$ETHA: 300 shares @ $18.39 (June 26, 2025)

$AAPL: 100 shares @ $201.00 (June 27, 2025)

$TOI: 4,000 shares @ $2.40 (June 30, 2025)

$CRM: 50 shares @ $270.00 (July 11, 2025)

Short:

$MSFT: 10 shares @ $487.00 (June 23, 2025)

$NVDA: 50 shares @ $144.40 (June 23, 2025)

$TSLA: 25 shares @ $355.00 (June 23, 2025) = +$8,875Closed July 7, 2025 @ $292 = +$1,575 (+17.75%)

🔹 Options Positions

Buy to Open: $DELL Jul 18 '25 $110 Put – 20 contracts @ $1.40 (June 23) = $2,800 Sold to Close @ $0.33 (June 30) = $660 (−76.4%)

Buy to Open: $FANG Sep 19 '25 $160 Call – 15 contracts @ $3.90 (June 23) = $5,850Buy to Open: $JPM Jul 18 '25 $260 Put – 10 contracts @ $2.70 (June 23) = $2,700 Sold to Close @ $0.60 (June 30) = $600 (−77.8%)Buy to Open: $AAPL Jul 11 '25 $215 Call – 50 contracts @ $0.30 (June 27) = $1,500 Sold to Close @ $3.75 (July 3) = $18,750 (+1,150%)Buy to Open: $IBIT Jul 11 '25 $63.5 Call – 10 contracts @ $0.58 (June 30) = $580 Sold to Close @ $1.16 (July 10) = $1,160 (+100%)Buy to Open: $CI Jul 18 '25 $300 Put – 12 contracts @ $0.55 (June 30) = $660 Sold to Close @ $2.50 (July 11) = $3,000 (+354.5%)Buy to Open: $ETHA Jul 18 '25 $20 Call – 20 contracts @ $0.61 (June 26) = $1,220 Sold to Close @ $2.55 (July 11) = $5,100 (+318.0%)Buy to Open: $GOOGL Jul 18 '25 $185 Call – 30 contracts @ $0.47 (July 8) = $1,410 Sold to Close @ $0.95 (July 11) = $2,850 (+102.1%)

Buy to Open: $LMT Sep 19 '25 $550 Call – 50 contracts @ $2.00 (July 11) = $10,000

Cash Balance

Starting Cash June 23 Inception: $100,000

Open Long Equity Cost: -$68,892 (as per purchase prices)

Open Options entry cost: -15,850

Open Short Equity Proceed: +$12090

Cash Available: $50,173 (adjusted for all open and closed positions)

Estimated portfolio value at July 11, 2025 Market Close including unrealized gains (Open options price is counted at entry price): $128,174.40 +28.17%. Of this 21.24% is from options and 6.93% is from equities.

My Substack was in the top 20 rising publications in finance for four days in a row this week and crossed the 500-subscriber mark within just three weeks of launch. I had promised all paying members that I would share my entries publicly without a paywall until I gained some exposure and reached 500 subscribers. That milestone has now been met.

Going forward, I will continue to share new equity positions after the market closes via my X account, once all members have had a chance to enter. However, I will no longer share any new open option positions publicly.

Reaching 500 subscribers in three weeks, even if most are on the free tier, is a huge milestone and I truly appreciate all the support. Now that the paywall will be turned on, most free subscribers will no longer see new plays. But if you don’t want to pay, you still have a way to upgrade for free. Substack will automatically upgrade you to one month of paid access if you refer five new subscribers, any tier including free, using your unique referral link that you can find here at the leaderboard. You can earn up to three and six months of paid access by reaching 12 and 25 total referrals.

If you’re part of any online communities, share your successful trades, spread the word, and post your link that comes from leaderboard while logged in. I’m looking forward to growing with all of you. Thank you again for the incredible support.

Where’s the live spreadsheet?